-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

The sooner you think about year-end planning and giving opportunities, the more time you’ll have to make the most of any situation. Economic conditions and your personal circumstances make the final month of 2024 an important time to review your finances.

Income Tax Strategies

Since income tax liability is calculated annually, strategically timing certain financial decisions can help you pay less while playing by the rules.

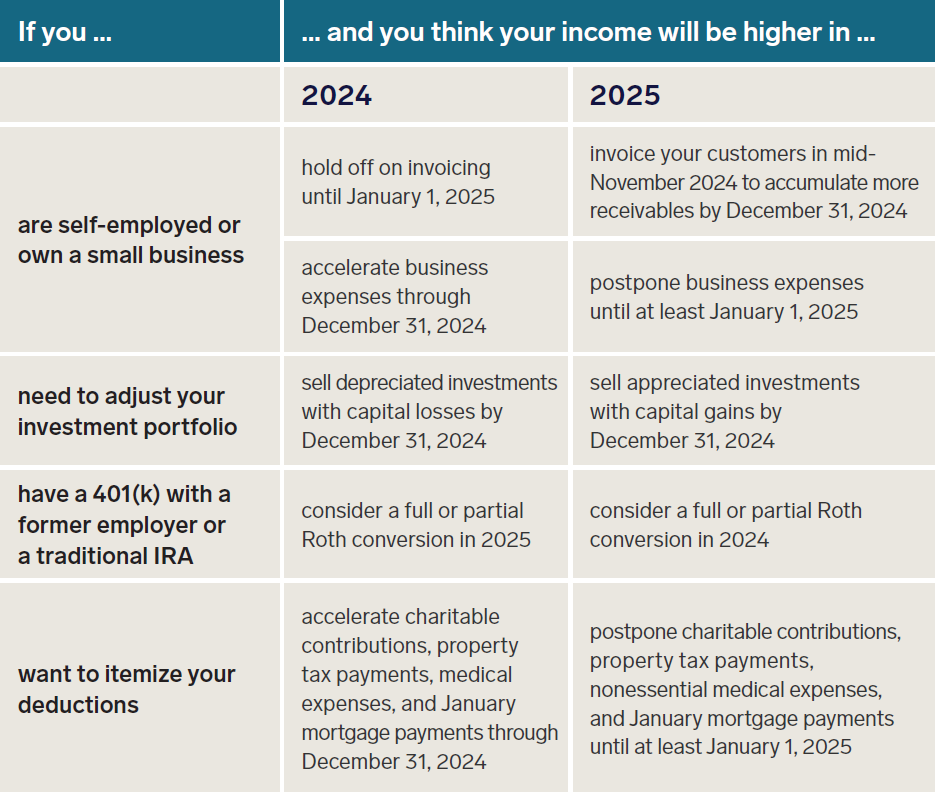

Defer or accelerate income and capital gains. Deferring income and capital gains until 2025 or accelerating them into 2024 could reduce your tax burden in both years. This strategy may include fully or partially converting an old 401(k) or a traditional IRA to a Roth IRA. You’ll have to predict what might happen next year, and predictions don’t always come true. This opportunity is worth a conversation with your Pitcairn team — especially if a major change or life event like retirement, a sabbatical, or moving to a new house is on the agenda.

Schedule deductions. Consider bundling medical, charitable, and other Schedule A deductions into one year to surpass the standard deduction and benefit from itemizing.

Lock in capital losses. At Pitcairn, we analyze client portfolios daily for opportunities to realize losses and reduce tax liability. You can deduct up to $3,000 in capital losses from your ordinary income this year and have the ability to carry over additional losses into future years. This would be in addition to any losses that have already been applied against realized gains.

Strategic Timing Can Save on Taxes

Work Benefits

Whether you work for yourself or someone else, you may have benefits that you can use to the fullest extent with a few tweaks before year end.

Maximize retirement contributions. 401(k) and 403(b) plans allow employee contributions of up to $23,000 in 2024 — plus an additional $7,500 if you’re 50 or older. Some 401(k) plans allow additional after- tax contributions as long as total employee and employer contributions don’t exceed $69,000. If you’re maxing out your contributions, a backdoor Roth or mega-backdoor Roth could help you save even more.

Spend FSA dollars. If you’ve contributed to a flexible spending account, make sure you’re on track to incur enough qualified medical expenses by year end to use up every dollar you contributed (the maximum for 2024 is $3,200). If not, now is a good time to book an extra visit with your doctor or dentist. Many people also purchase extra prescription glasses, contact lenses, and over-the-counter medications with surplus FSA funds. If you anticipate higher medical expenses next year, you may be able to carry over up to $640 for 2025 if your employer allows it.

Max out HSA contributions. If you have a high-deductible health insurance plan, you may be eligible to contribute up to $4,150 individually or up to $8,300 as a couple or family to a health savings account. If you (and/or your spouse) are 55 or older, you may (each) be eligible to contribute an additional $1,000.

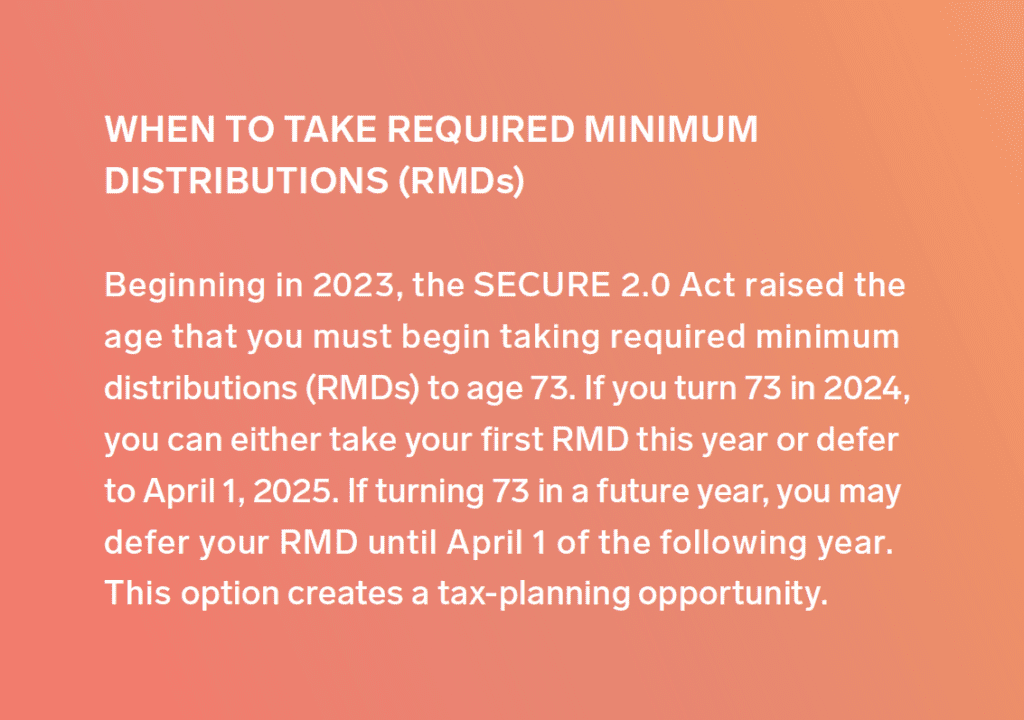

Take RMDs/QCDs. You’ll incur steep penalties if you don’t take required minimum distributions from your tax deferred retirement accounts — such as 401(k)s and traditional IRAs — by December 31, 2024. For taxable RMDs that you don’t need for living expenses, you may wish to take a qualified charitable distribution of up to $105,000 instead. That money won’t be included in your annual adjusted gross income and could be part of your overall philanthropic giving.

Gift, Estate, and Intergenerational Planning

Here are several gifting and estate-planning items to consider before December 31.

Compound your gift. A 529 plan can be pre-funded with up to five years’ worth of annual exclusion gifts in a single year ($90,000), creating more time for compound growth.

Take advantage of annual exclusion gifts. If you haven’t used up your annual exclusion gifts, now is the time. Individuals can give up to $18,000 per recipient, without a limit on the number of recipients, in 2024. These can be cash gifts, but in some cases, it could make sense to give investment assets that have high growth potential.

Provide the gift of education. Some families may find value in using their annual exclusion gifts to fund a 529 plan in the name of a child or grandchild who is likely to attend college. Parents and grandparents can use this strategy to remove assets from their taxable estates without using up any of their lifetime estate tax exclusion — while contributing to future education expenses in tax-advantaged accounts. In addition, tuition payments that are made directly to an educational institution are exempt from gift taxes and therefore do not count towards the annual exclusion amount.

Help fund a charity. Along with giving to family, you may want to give to your favorite charities. Whether you give cash, appreciated stock (especially low-basis stock), or other assets, you may be able to reduce your taxable income (or taxable estate) while making a profound difference in someone else’s life.

Update planning documents. It’s never a bad time to make sure your estate plan is up to date. Who are the beneficiaries on your payable-on-death accounts and your life insurance policies? Do your existing trustee appointments and bequests still fit your overall wealth plan and objectives? It may be time to remove an ex-spouse, add a child, or change a trustee.

Appoint personal representatives. Everyone should consider appointing a healthcare proxy and financial power of attorney. You’ll need witnessed or notarized documents to name reliable individuals to legally make health and financial decisions on your behalf in the event of incapacitation. The events that can render us incapacitated often arrive without warning, so it’s best to appoint trusted representatives, whether you expect to need their help or not.

Closing Thoughts

We hope this guide has piqued your interest in financial moves that could be worth making before year end. Reach out to your Pitcairn team for a personalized analysis and discussion. Then, let us handle the logistics while you enjoy a much-needed break.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.