-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

KEY TAKEAWAYS

- US equities delivered another exceptional 25% annual return in 2024. Enthusiasm following the election led to a noteworthy November rally, as hope for reduced regulation sparked positivity and a continuation of the summer’s bull market dynamics.

- A new year is a good time to reflect on the bigger picture. That picture is a landscape of technological, political, and societal change with substantial long-term implications and opportunities.

- Bull markets commonly experience meaningful corrections. Whether or not the long-anticipated pullback occurs, we believe the future is bright for US stocks. Therefore, we will stay diverse and be ready for whatever 2025 brings.

This time last year, we were celebrating a 26% return for US stocks and were cautiously optimistic about the coming year because we saw more tailwinds than headwinds for

US stocks. Those tailwinds propelled US equities to another exceptional 25% annual return in 2024. In five of the last six calendar years, US stocks, represented by the S&P 500 Index, have delivered returns above 20%. That record is astounding and an excellent outcome for long-term investors with substantial equity exposure.

As we close the book on 2024 and turn the calendar to 2025, it’s easy to imagine a parallel market demarcation. Though we generally measure investment results and manager performance by the calendar, market inflection points rarely align so neatly. Absent a catalyst for change, underlying market trends and sentiment will likely continue seamlessly from one year to the next.

For investors, however, a new year is a good time to take a step back and reflect on the bigger picture. In that picture, I see a landscape of technological, political, and societal change with substantial long-term implications and opportunities. We live in extraordinary times.

I recently saw a study that claimed the GLP-1 obesity drug class could add 2% to annual GDP. I can believe 0.2%, but 2% seems incredible. However, analysts predict drugs like Ozempic will be groundbreaking in reducing doctor visits and increasing productivity. This is a harbinger of a remarkable confluence of technology and DNA knowledge that will increase lifespans, cure diseases, and improve quality of life.

Meanwhile, artificial intelligence in the workplace seems poised to transform the service sector. As just one example of what’s in store, I heard a private equity firm explain that AI could cut the timeline from initial due diligence to final decision from about 85 days currently to just four or five days. As investors, we must be cognizant of accelerated decision making and other potential developments. We must understand the effect on our strategies, including buy/sell decisions, and what adjustments we might have to make.

Along with technological advances, we have seen political realignments in the US and across the globe. We don’t yet know the full consequences of the widespread populist push. Along with significant change in Malaysia and Argentina, Canadian Prime Minister Justin Trudeau recently announced his resignation, and political change continues in the UK and Europe.

Whether we are excited or nervous about these developments, we can’t deny they are happening. Societal changes always involve risk, but the opportunities far outweigh the negative prospects. History has shown this time and time again.

Post-Election Rally Drives Positive Fourth Quarter Results

In my June 2024 outlook, I noted that the dynamics of the bull market were unlikely to change before the election, which proved to be the case. I was pretty confident the election would not be an inflection point regardless of which candidate prevailed. However, I did think that if Trump were re-elected, stocks would forego the big bounce that happened in 2016, given potential media negativity.

Societal changes always involve risk, but the opportunities far outweigh the negative prospects. History has shown this time and time again.

Instead, enthusiasm following the election led to a noteworthy November rally. I don’t think I appreciated the degree to which some companies and industries felt constrained by regulation during the previous administration. Hope for reduced regulation sparked positivity, and we saw a continuation of the summer’s bull market dynamics.

The re-emergence of the momentum rally was a key driver. Before November, there had been some broadening of the market. Then, bitcoin gains and anticipation of an anti regulatory administration unleashed technology stocks, particularly the Magnificent Seven, reverting to a narrower market toward year-end.

US stocks gave back some of November’s gains in December. Though a down December is unusual, the pullback doesn’t worry me. I attribute it partly to comments from Federal Reserve Chair Jerome Powell and partly to investors reassessing after a 60% gain in the S&P 500 Index over the past two years.

Powell’s post-election comments signaled a less aggressive rate-cut path for 2025, with a sober tone reflecting the challenge of balancing inflation control with support for economic growth. Though inflation is likely to stay tame next year, potential factors could exacerbate it, and the Fed must be prepared to respond.

In addition to the Fed’s comments, investors focused on the calendar and questioned whether supportive economic trends would continue into 2025. I do not see December’s results as prophetic for the next six or 12 months of returns. January’s results will be more telling.

Taking the Pulse of a New Presidential Administration

I always discourage investors from letting politics overly influence investment plans because presidential administrations rarely have long-term effects on markets. However, I believe this administration aspires to have the kind of impact that presidents like Ronald Reagan and Franklin Delano Roosevelt had. Whether it achieves that ambition remains to be seen. Still, I’m not sure the market fully appreciates the implications of the proposed policies and how they would work their way through the government and capital markets.

The question is how the Trump administration will react if its policies unsettle the stock market. President Trump’s marketing impulse is very strong, and we know he considers the stock market a key measure of success. I doubt he will remain wedded to initiatives that threaten stocks or endanger economic growth — even in the short run.

Thus, the emphasis will be on pro-business initiatives with a toning down of the campaign bluster. The administration will likely adopt an anti-regulatory stance that would benefit M&A, IPOs, etc., positively affecting capital markets. Conversely, blanket tariffs and mass deportations do not comport with high stock valuations and current low volatility.

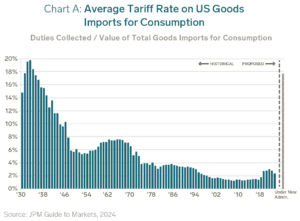

Chart A shows how the proposed Trump tariffs compare to US tariff history. Tariffs of 10% or 20% across the board would be highly inflationary. It’s encouraging that formal administration roles have generally gone to mainstream financial professionals rather than tariff extremists. For example, Trump named Scott Bessent his nominee for the Treasury Secretary position. Bessent is a respected macro investor with a firm understanding of economic dynamics.

In the first Trump term, the negative impacts of his bluster were overestimated; the same may be true now. I hope the administration will be pragmatic, using tariffs judiciously to bring industry back to the US and curb certain countries’ negative behaviors. Similarly, I am hopeful the administration focuses on deporting proven criminals rather than mass deportations that would drive higher labor costs and be expensive to implement.

Earnings and the 10-Year Treasury Yield are Key Indicators for 2025

The US stock market is expensive by any measure. But we seem to be standing on the precipice of incredible productivity advances, so perhaps traditional valuation measures are less meaningful. Robust equity growth will continue as we internalize the dramatic nature of the technical revolution before us.

Data show the US economy remains resilient, seemingly on firmer ground than the stock market. I don’t see a recession in the cards this year. President Trump would pivot if a recession scare resulted from the new administration’s actions. Of course, I could make the case that it might be better to endure a recession to re-rationalize valuations, government spending, and market excesses, but I don’t see that happening.

In my view, the 10-year Treasury yield and technology earnings are two key barometers of market results in 2025.

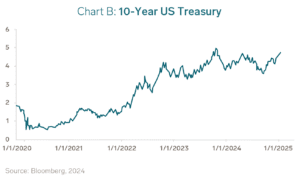

The 10-year Treasury yield represents the price of money and has an incredible amount of data packed into it. Primarily a gauge for inflation and debt concerns, the 10-year yield signals the future path of the US economy and GDP growth. We saw a notable step down in the 10-year yield just after the election. The 10-year hit a low of 4.1% before rising again in December. As of January 21, the 10-year was at 4.57%.

Over the last two years, yields have stayed relatively low as foreign demand for US debt remained high. However, as US debt and deficits rise, at some point, our foreign creditors might ask to be paid more, driving yields higher.

On the positive side, the path for inflation appears benign — price increases did prove to be largely transitory. However, to the extent that we keep printing money and racking up the national debt, it stands to reason that the 10-year Treasury yield would remain high, and bond markets would pressure equities.

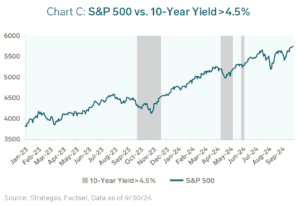

Our colleagues at Strategas Research Partners have compiled data showing that when the 10-year Treasury yield hits about 4.5%, it pressures equity prices, and stocks may pull back. US stocks are not priced for that pressure right now; they are priced for low volatility, declining inflation, and 3%-4% yields in the bond market. Anything outside those bounds could spike volatility — for example, if earnings slump or the Trump administration makes a policy error. If the 10-year Treasury yield pushes against 5%, I don’t think markets can stay where they are.

On the earnings side, growth held up well in the fourth quarter. The question is whether the earnings train keeps chugging along. Forward earnings forecasts are very aggressive – about 12% growth on S&P earnings in 2025 and 14% in 2026. Anything that impedes earnings growth, such as slowing GDP, would threaten stocks priced for perfection.

Later this quarter, reports from Microsoft, Google, and NVIDIA will give us some indication of how well earnings are holding up. We will see whether management guidance is guarded or signaling full speed ahead. Caution or a burp from any of the Magnificent Seven technology stocks (Amazon, Alphabet, Apple, NVIDIA, Meta, Microsoft, and Tesla) could affect the broader stock market.

While I believe a significant geopolitical incident is the only outcome that might derail capital markets, the probability of such an event remains low.

Can we count on GDP growth to support earnings? For the past few years, increased government spending has provided a steroid shot to keep the economy humming and stave off the recession predicted by an inverted yield curve. Soon, that spending will compete with Elon Musk’s quest to streamline and shut down government agencies.

Fortunately for GDP growth, consumption may replace lost government spending. Rising stock prices have boosted consumers’ household wealth and, by extension, the consumption component of GDP. Household wealth grew by $15 trillion over the past two years. As for the other major GDP component – corporate spending – we expect it to remain solid, mainly as companies are unlikely to put the brakes on AI investments. Nonetheless, we cannot rule out the possibility that an execution error in reducing government spending could meaningfully change the growth picture.

Non-US Stocks Expected to Underperform Near Term

Non-US equities trailed US equities by double digits in 2024, but I am not giving up on a global investment portfolio. Policy actions of the second Trump administration are likely to support continued US dollar strength, prolonging the drag on international securities. Therefore, absent a toe stub on the US side, international stocks will likely underperform again in 2025.

Still, this remains a global economy. At some point, the dollar will reflect US liabilities and profligate spending, weakening against a basket of other currencies. Also, many non-US markets do not exhibit the risks inherent in the technology-driven US market. Nonetheless, the current momentum behind tech is strong, so a reset is not likely any time soon.

Successful global investors recognize and capitalize on disparities among non-US markets. For example, weakness in the European region has dragged down overall non-US returns, potentially obscuring good performance and opportunities in other areas. Most international exposure in Pitcairn portfolios is actively managed, so our discerning managers can de-emphasize underperforming areas like Europe while taking advantage of better opportunities.

Geopolitics Remains a Low Probability Risk

While I believe a significant geopolitical incident is the only outcome that might derail capital markets, the probability of such an event remains low.

There are numerous hot spots around the globe, and events of the past quarter have underscored the incredible technological change in warfare, including the deployment of inexpensive drones and the use of AI to analyze prodigious amounts of data rapidly. Warfare becoming more software than hardware-based could empower technologically advanced countries that lack massive militaries and weaponry.

However, I still believe the probability of a geopolitical blowup is low since we cannot know when, where, or how such an event might unfold; the only strategy we can employ is to maintain diversified portfolios.

Protected by Diversification and Buoyed by Optimism

I remain quite optimistic about where we stand in the arc of humanity. We can bring incredible abundance to people worldwide if we successfully manage this technological, societal, and political inflection point. This period of change will end well, and I say that because every other technology-driven societal change I have studied has been positive for global growth and humanity. Pointing out risks may be in vogue, but remember, it has been far more profitable to be a believer in the US economy and US stocks over the past 50 years than not.

...it has been far more profitable to be a believer in the US economy and US stocks over the past 50 years than not.

For the last two years, US stocks have climbed a wall of worry and risen 60%. Stocks are sitting at record valuations on pillars that might be a little shaky. We must be clear-eyed about the reality that a pullback could happen anytime. Investors must understand that bull markets commonly experience meaningful corrections. I am confident any pullback will not derail a promising future. We had a 19% pullback in 2022, and who even remembers it in the wake of subsequent gains? A 15%-20% correction would not be overly concerning.

That said, I caution against the chasing mentality and emphasize that this late in a bull market is not the time to get tactical. Investors are much more likely to benefit from a portfolio designed to withstand volatility than trying to guess what random triggers could spark a pullback.

Pitcairn portfolios have had substantial allocations to equities since 2009, and those who have been with us for that ride have done incredibly well without giving up the downside protection provided by diversification. As committed equity investors, let’s stay diverse and be ready for whatever 2025 brings. Diversification will protect holdings of gold, infrastructure, fixed income, and other sectors if stocks fall to cushion the impact. But as an optimist, I believe the future is bright for US stocks whether or not they experience the long-anticipated pullback.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.