-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

KEY TAKEAWAYS

- Amid a parade of consequential events, US stocks rose more than 6%, with performance broadening to include real estate, financials, banks, utilities, and small-cap stocks.

- The long-anticipated Federal Reserve pivot finally came to fruition in the third quarter with a substantial 0.50% cut to the federal funds rate.

- Geopolitical, economic, and technological changes are creating opportunities and uncertainty. Meanwhile, traditional economic indicators have been less predictive, making it more important than ever to hold a dynamic, well-diversified portfolio.

“Fairly uneventful, stable economic backdrop, and rising equities” is how I would succinctly describe the second quarter of 2024. It was quite a different story in the third quarter as one consequential or unexpected event followed another in rapid succession. And through it all, the equity rally resolutely soldiered on.

Here’s a quick summary of noteworthy events that happened since the last quarter:

- A presidential debate sparked a dramatic reset in US politics with President Joe Biden ending his campaign and Vice President Kamala Harris becoming the Democratic nominee mere months before election day.

- Two assassination attempts were made on the Republican presidential nominee, former President Donald Trump.

- US and global equities took a tumble in August but quickly recovered.

- Ukraine launched an incursion into Russia.

- A ceasefire between Israel and Hamas remained out of reach.

- The conflict between Israel and Lebanon-based Hezbollah escalated. Israel’s killing of the militant group’s long-time leader and Iran’s retaliatory missile attack raised fears of a broader regional war.

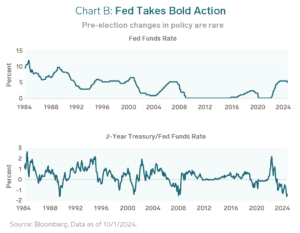

- The Federal Reserve reversed its monetary policy stance and cut the federal funds rates by a significant 0.50%, an unusual move so close to a national election.

- China’s government implemented an array of measures to stimulate its slowing economy, and Chinese stocks rose more than 4% after a long, long period of malaise.

- Two major hurricanes cut a swath of destruction across the southeastern US.

While that list of extraordinary events might, logically, cause a fear-induced sell-off, US stocks continued their march upward in 2024, seemingly unphased by US or world events. The Russell 3000 Index returned 6.2% for the quarter, with a 20.6% gain year to date.

Backed by Data, the Fed Cut Rates as US Election Approached

The long-anticipated Federal Reserve interest rate cut finally occurred in the third quarter. The Fed prides itself on independence and normally avoids actions that might be perceived as partisan. In past election cycles, it has sometimes continued rate-cutting or hiking cycles already underway, but a meaningful pivot this close to an election is exceedingly rare. Nevertheless, the Fed reversed its monetary policy stance at its September meeting and initiated a cutting cycle.

With GDP growth still solid, employment numbers just beginning to slow, and stocks at all-time highs, it’s worth discussing the Fed’s motivation. My perspective is that the Fed remains sensitive to criticism it was caught flat-footed when inflation started to rise and wants to show it has a firm grip on the data and can control inflation without sending the economy into a sharp recession.

In July, the Fed indicated it would hold rates steady and consider further data. Subsequent data indicated some weakening, and, in hindsight, the Fed might have wished it had cut 0.25% in July and another 0.25% in September. Rather than risk continued deterioration and confident that data released after the July meeting supported its action, the Fed moved decisively in September, cutting the federal funds rate by 0.50%.

Eighteen months ago, investors and pundits were preoccupied by the intractable 1970s inflation and the possibility of a repeat performance. Today’s consensus is that recent inflation was mainly pandemic-driven, fueled by supply chain issues and monetary stimulus, and has now been brought to heel. Seeing inflation as a cyclical phenomenon, with another wave possible, is a minority view at the moment, one that may overlook longer-term inflationary forces.

Excessive US Spending and Economic Chokepoints Suggest Higher Base Inflation

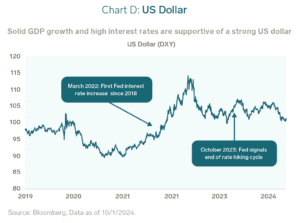

We may have just entered a Fed-cutting cycle, but the world has still turned the corner from the nearly zero inflationary environment of 2009 through 2020. Signs point to future inflationary pressures, including high US spending that may debase the US dollar and new economic choke points that could cause supply/demand imbalances.

We have written frequently about high US deficit spending and my hope for greater fiscal responsibility. Current US economic strength is at least partly supported by massive deficit spending over the past 24 to 36 months. Spending is already at recession levels, and while it appears an economic soft landing may be successful, will spending run up to 10 or 11% if a recession occurs? Politicians of both parties are comfortable with a massive debt load. It remains to be seen how that will affect the dollar and perception of US debt quality, as well as whether colossal productivity gains from AI make deficit concerns a moot point.

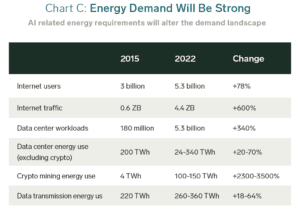

In terms of possible economic choke points, energy is an example of a constrained resource that could prove inflationary and disruptive. At its peak, energy consumption for crypto mining rivaled the energy use of entire countries such as Australia and Sweden. AI energy needs are exponentially higher. Microsoft recently inked a deal to reopen Pennsylvania’s Three Mile Island nuclear plant and sell that power exclusively to Microsoft to fuel its AI energy needs. Microsoft must foresee a severe crimp in energy availability to make this commitment. On the positive side, rising energy demand may translate to a strategic advantage for the US with its vast energy resources relative to Asia and Europe.

Similarly, the ingenuity and dynamic nature of the US economy is likely to mute any risks to the US dollar. No other currency poses a credible threat to the US dollar’s global dominance, precisely due to US economic leadership. If we compare the three major global commerce realms — the US, Asia, and Europe — which one do you want? The US economy stands head and shoulders above the rest, and US stocks have trounced stocks in Asia and Europe for as long as I have been at Pitcairn.

Market Tenor Subtly Shifts as Stocks Quickly Move Past August Dip

Stocks experienced one notable dip during the quarter. You might reasonably presume the catalyst was politics, but in fact, the focus has been much more on the Fed. Inflation and job-related data caused some concern about the health of the US economy and technology sector. The combination of heightened US concerns and a surprise rate increase by the Bank of Japan led to the unwinding of an esoteric Yen carry trade, further roiling global markets and erasing recent gains in Japanese stocks. Ultimately, the August decline was barely a hiccup in the US equity market’s upward trajectory.

There was, however, a change in the nature of the rally. Before the dip, market gains remained top-heavy, driven by a small number of stocks, notably the Magnificent Seven tech stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla). After the dip, technology was still doing well, but other sectors began to share in the gains, including real estate, financials, banks, and utilities.

I have been preaching for quite a while that narrow market leadership is bad, so this broadening is good news. However, it did raise the question of whether stronger performance from financials, utilities, and real estate marked the beginning of a rotation into stocks that might do better in an economic slowdown, a possible precursor to weakening US growth. That concern faded as the Fed’s rate cut reignited a fire under growthier stock segments. As further evidence of market broadening, small-cap stocks saw better returns after the August dip and even more so since the rate cut. Small-caps ended the quarter up 9.3%, well ahead of large-cap stocks.

The ingenuity and dynamic nature of the US economy is likely to mute any risks to the US dollar.

Global Tensions Remain, But China’s Stimulus is a Strong Pro-Asia Signal

Consequential geopolitical changes are happening, with potential ramifications for non-US investments. The realignment of populations, the Russia/Ukraine war, and tensions in the Middle East and Asia all contribute to a theme of global uncertainty. A geopolitical surprise is not probable before the election. Meanwhile, I am looking beyond the election.

I am constitutionally a bullish investor and maintain a bullish outlook for global asset classes. That does not mean overlooking or discounting possible risks but rather trying to determine a realistic probability of a risk occurring. For example, a bear might say that now is a time to avoid China for fear that it might invade Taiwan. I assign a low probability of China invading Taiwan and a higher probability of China’s recent economic stimulus being a strong pro-Asia signal and a tailwind for emerging market stocks. Consequently, I would conclude that being short Asia in the current environment is short-sighted.

At a time when China’s government has taken steps to push its stocks higher, and the US is concurrently debasing its currency, at least at the margin, we should consider how this paradigm might color investing in other countries. History shows us that periods of prolonged Chinese stimulus provide tailwinds for much of the emerging market universe. Brazilian and Mexican markets and currencies have performed well in such times. India may be an exception. I am a fan of India and its prospects. However, the attraction of India’s markets rose as China’s prospects dimmed, and now some investors are retracing that move and rotating from India back into China.

US Stocks Anticipate Gridlock No Matter the Election Outcome

We have always discouraged Pitcairn client families from letting politics unduly sway their investment decisions. That said, we still carefully monitor all factors that may affect short or long-term market results, certainly including the 2024 election, which has been anything but typical. One party’s candidate was convicted of fraud in May, the other’s stepped down after a widely disparaged debate performance. Election news bombards us from every side, yet the markets seem agnostic.

Before President Joseph Biden withdrew, we had analyzed the historical outcomes when a president runs for re-election. Technically, this is now an open election, but we can’t discount Vice President Kamala Harris’s role in the incumbent administration. Generally, the incumbent party retains power if the stock market performs well in the weeks preceding an election. That’s logical because people express satisfaction and optimism through activity in the capital markets. The stock market has been doing well for the last few weeks, which leans toward a Harris win. Nevertheless, markets have largely shrugged off headlines favoring one candidate or the other and appear comfortable with the prospect of a divided government.

Markets typically prefer divided power — a president of one party and at least one legislative house controlled by the opposition — because it reduces the possibility of unfettered policy progress. In the unlikely event that either Democrats or Republicans sweep this election, history suggests markets would react negatively, but that is not a given in the current environment. Our colleagues at Strategas Research Partners contend that even if one party gains full control, its ability to move policy would be limited by the near 50/50 party divide within the Senate and the House of Representatives. This entrenched national divide may be a key reason there has been so little market volatility in the face of changing political tides.

I should note one caveat. A protracted contest involving court cases, recounts, etc., as in the Bush/Gore 2000 election, could disrupt markets. The best-case scenario is that we wake up on Wednesday after Election Day with some governance certainty for the coming year. If not, we may see stress in the capital markets, but nothing that should disrupt long-term investment plans.

Long-term US Equity Prospects are Favorable

US stocks feel a little uncomfortable at these elevated valuation levels, but it would be even more painful to be out of a market with so much momentum behind it. Once the election is over, if results are generally in line with market expectations, a near-term rally would not be surprising, given increased certainty for the coming year. Beyond that, I don’t believe trees grow to the sky.

The capital market assumption for US stocks is about 8% annually, a superior return that results from a mix of double-digit, single-digit, and negative returns. With US stocks having risen about 25% in 2023 and over 20% so far in 2024, it would not be surprising if markets take a breather to bring us back to the long-term assumed rate.

Of course, if productivity gains from the AI revolution meet expectations, potentially offsetting the effects of rising US debt levels, the long-term outlook for US stocks looks awesome. The bearish counterpoint for the short term would be that the AI/technology revolution might take much longer than expected to produce massive earnings growth. Under that scenario, the Fed’s 0.50% cut might end up being premature. There’s currently some air under US stock valuations, and if support softens, we might wish the Fed had held its fire until the rate cut could have done more good rather than making the cut when stocks were already at record highs.

Unparalleled economic dynamism and vast energy resources give the US substantial long-term strategic advantages over the rest of the world, including China and Europe.

Still, unparalleled economic dynamism and vast energy resources give the US substantial long-term strategic advantages over the rest of the world, including China and Europe. I am confident that will not change, regardless of dollar strength, inflation, the AI story, or November’s election results. Instead of focusing on how various factors might tweak markets in the short term, investors should consider how consequential, longer- term trends may play out to the advantage or disadvantage of different asset classes. You won’t be shocked to know this leads me directly to the importance of holding diverse portfolios.

Expanding Opportunities and Rising Uncertainty Reaffirm the Value of Diversified Portfolios

As the world responds to geopolitical, economic, and technological changes, we find ourselves in a period of expanding opportunities and rising uncertainty. It has been particularly disconcerting to see the predictive ability of familiar economic indicators, including the inverted yield curve, fail so spectacularly during the post-pandemic period.

Less reliable economic indicators make capital markets less predictable, making it more critical than ever to hold a dynamic, well-diversified portfolio so you are exposed to a broad range of promising investments and not bet the house on any particular opportunity or outcome. We have promoted the value of diverse portfolios for a long time, and we will continue to do so because our clients have been successful in pursuing precisely this strategy.

*Please Note: Limitations. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Pitcairn, will be profitable, equal any historical performance level(s), or prove successful.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.