-

Who We Are

Who We Are

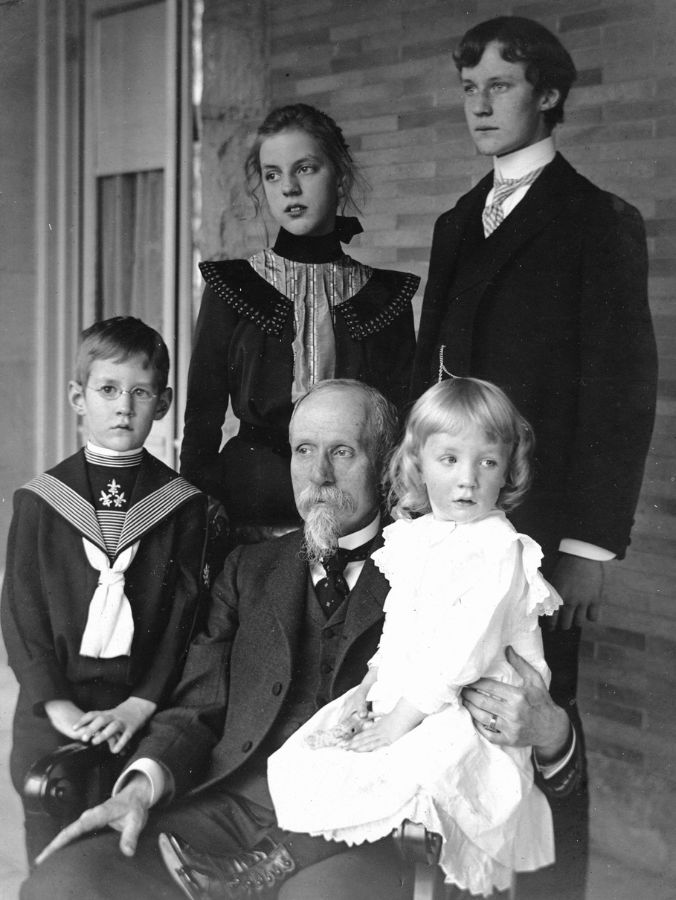

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Markets like certainty and a definitive victory for one side in the US presidential election gave investors a sign of relief. Chief Global Strategist Rick Pitcairn says in the latest Market in 5 Charts that the bullish sentiment post-election is partly because of the outcome and business fundamentals. Optimism driven by corporate earnings and sector trends, particularly the rise of crypto assets like Bitcoin, have countered declines in gold and specific sectors like pharma. But as Rick notes, “there’s a lot of inflationary pressures coming out of potential Trump policies, and the market’s watching that.”

*Please Note: Limitations. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Pitcairn) will be profitable, equal any historical performance level(s), or prove successful.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.