-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

KEY TAKEAWAYS

- The backdrop for the feverish US equity rally remained intact in the second quarter and appears likely to remain so, at least through the US presidential election.

- A lower 10-year yield and slowing in sectors such as retail give the Federal Reserve leeway to cut interest rates, if it chooses to. The consensus is for one or two rate cuts this year.

- Maintaining a portfolio’s international footprint is critical as we begin to see better results from non-US stocks.

- Markets are currently in a virtuous cycle, but all cycles eventually end. Now is the time to ensure appropriate diversity in portfolios.

At the end of some quarters, when I begin to write this letter, so much has happened during the previous three months that I have trouble deciding where to start. That was definitely the case last winter. Not so today.

The Federal Reserve left interest rates alone — still at the level set in July 2023. US corporate earnings remained solid, with S&P 500 earnings projected to end the year at $222.94, up 0.6% over 2023. Inflation has been sticky, mainly in the services sector, but seems to be moderating. Election year fiscal spending has been predictably abundant but may slow as the election approaches. Though conditions don’t cry out for a rate cut, at least one appears likely before year end.

In short, the backdrop for the feverish US equity rally, which seems to be pulling up asset prices all over the world, remained intact in the second quarter and appears likely to remain so, at least through the US election.

Rising US Equities Test Commitment to Rules-Based Investing

The endurance and magnitude of the US equity rally have been so remarkable, it has some investors asking, “Why bother with anything but US equities?” More than once over the last three months, I have heard fellow members of investment committees as well as wealthy investors question long-term asset allocation plans and advocate for concentrating assets in US equities. That kind of thinking might make sense if one only considers the recent 15-year period of US outperformance. But 15 years is just a blip in market history and the time horizons of multi-generational families.

The US is in an unusual period. Stock prices and housing prices are at record highs, the country is at full employment, inflation and interest rates are higher than they have been in a decade. Times when market conditions are unusual or swing to extremes — as may now be the case — are often times when emotions displace rules-based decision making. That is one of the costliest mistakes investors can make. Unusual market conditions make adhering to fundamental investing rules more essential than ever.

US Equity Gains Poised to Continue, For Now

To be sure, the current US equity market is not one that investors should run from. The backdrop that fueled gains in the first and second quarter will likely continue at least until the election, given strong tailwinds from election year fiscal spending, the probability of a Fed rate cut, and continuing optimism surrounding the age of AI.

Throughout this year, we have been saying that a geopolitical crisis seems to be the only thing that might meaningfully disrupt markets before the US election, and that seems unlikely. Aside from existing global flashpoints that are well known to the markets, China’s potential aggression toward Taiwan has raised concerns, but it seems unlikely China will invite military conflict with the US, the country’s best customer.

It’s hard to discount how much the promise of AI is boosting index performance. After a somewhat weak start to the quarter in April, large-cap equities, particularly technology stocks, have generally kept rising. In fact, this has so far been the US market’s second-best performance in a presidential election year since 1976, when the market, as measured by the S&P 500, gained 17.8% in the first half of the year.

Times when market conditions are unusual or swing to extremes — as may now be the case — are often times when emotions displace rules-based decision making. That is one of the costliest mistakes investors can make.

Rising Market is Not Without Risks

Tailwinds notwithstanding, those of us who remember similar cycles of market optimism encourage investors to maintain a longer view and structure portfolios in a way that provides protection when, inevitably, optimism wanes and equities deliver a negative annual return.

Tremendous concentration remains a concern as a select group of tech stocks still drive market returns. These mega-cap technology leaders are rising on hopes that the transformative nature of AI will create massive earnings growth. We are led to believe we shouldn’t worry about concentration or valuation because the moats around these large tech companies are so strong and the promise of AI so extraordinary.

Remember, however, that the Magnificent Seven stocks did not have a good year in 2022. They got slapped around in a major way that was not fun for investors. Since then, it seems like somebody has used the Men in Black neuralyzer to wipe investors’ minds, because so many seem to have repressed that memory.

The combined weight of the three largest stocks in the S&P 500 Index was close to 18% as of June 30th. It has not been that large in recent history. Even though we believe in the promise of AI, including market darling Nvidia, the extreme narrowness of this market is reason for wariness. Consider that Nvidia’s largest clients include the rest of the Magnificent Seven — Google, Amazon, etc. The inter-dependency of market leaders could increase risk, as we saw when Nvidia’s few bad trading sessions in April and June negatively affected the indexes. I don’t believe those few weak days were a significant red flag for Nvidia, but they certainly revealed some vulnerability.

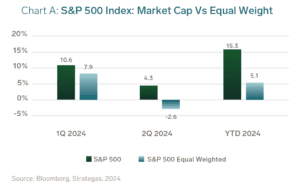

Another way to look at market breadth, or lack of it, is to compare the returns of the S&P 500 Index with the Equal Weight S&P 500 Index. The commonly cited S&P 500 Index is market-cap weighted, which means larger companies have larger index weights and greater influence on return. Conversely, in the S&P 500 Equal Weight Index all constituents have the same weight regardless of company size and have equal influence on return. The market-cap weighted S&P 500 returned 15.1% for the first half of 2024; the equal weight index returned just 5.1%. (See Chart A: 2024 Year-To-Date Performance, S&P 500 Market Cap vs Equal Weight)

Valuations Still Matter

More than a few investors and pundits scoff at the relevance of valuations of late. The premise is that AI transformation will be so massive, valuations just won’t matter. I have been around too long to believe that. Valuations always matter. They may play out differently in different cycles, and this long post-COVID cycle has certainly created anomalies that complicate the valuation picture. But hear me: valuations still matter.

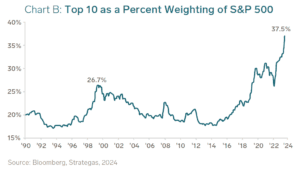

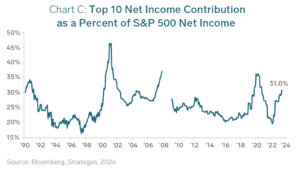

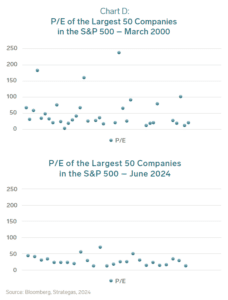

The US stock market, as a whole, is not showing major signs of egregious overvaluation, in my view. Yes, it is overvalued, but not as much as in 1999. Nor are there signs of a bubble about to pop. Chart B shows that the top 10 stocks in the S&P 500 have risen to combined weight of 37%. However, Chart C shows that those companies also account for a rising share of index earnings. In Chart D: P/E of the 50 Largest S&P 500 Companies, you can see that P/Es of the largest companies currently fall in a fairly narrow band. That is notably different from the year 2000, when many of the largest companies were outliers with much higher valuations.

Though valuations may not appear extreme at present, psychologically, current conditions are beginning to remind me of other bull market endings, particularly a willingness to ignore valuations.

The Fed’s Next Move

Ever since inflation began to recede in the aftermath of COVID, there has been a dichotomy between those who think inflation comes in waves and is likely to roar back and those who believe significant inflation is behind us. Many times, we have highlighted the mistakes made in the 1970s when the Fed eased too early and took 10 years to finally bring inflation under control. In the current environment, however, concerns that inflation will spike again are very much the minority view among pundits.

Recession fears have also receded as the typical election year bump in fiscal spending and ongoing AI optimism have solidified consensus forecasts for a 1995-style “soft landing” for the US economy. I believe this remains somewhat in doubt, particularly considering that 1995 marks the only occasion when the Fed was able to tighten interest rates and avoid a recession.

As the Fed tries to anticipate what conditions will be seven or eight months from now, it still lacks conclusive data on whether or not an interest rate cut is necessary. A judgment call will have to be made.

The 10-year US Treasury yield swung widely during the quarter before ending at 4.40%. Notably, between late April and mid-July, the 10-year yield fell, which suggests a sense of economic slowing that is substantiated by late-quarter data releases.

The lower 10-year yield and slowing in sectors such as retail give the Fed leeway to cut rates if it chooses to. As I have said in the last few letters, I believe the Fed’s inclination is to cut. During the second quarter, the European Central Bank, the Swiss central bank and Canada’s central bank, among others, have all cut interest rates. Consensus is that the Fed will fall in line with other central banks and cut rates once or twice this year.

I do think the Fed would like to wait until after the election. I sense that Fed Chair Jerome Powell approaches decisions a little more by gut than some previous Fed chairs, such as Janet Yellen and Ben Bernanke, who were more data-driven. However, I think he would rather not cut before the election in order to avoid appearing political. As long as the data are inconclusive, he has some flexibility. In the end, I think one or two cuts are possible. However, if the Fed wants two cuts before year end, it may have to make one before the election.

Non-US investments in a Changing World

While the US closes in on its November election, there have already been a number of consequential elections around the globe, including India, Mexico, the UK and Europe. In India, Narendra Modi, a free-market proponent whose leadership contributed to India’s recent economic and market strength, remained in office, but lost some power. Under a likely power sharing arrangement, I expect India to remain a rising economic force. In Mexico, the country’s first woman president, Claudia Sheinbaum, represents a continuation of the former president’s left-leaning Morena party, which now has a legislative super-majority. This may not be positive short term, but ultimately the effect on Mexico’s undeniable economic potential may depend on whether Sheinbaum governs more pragmatically than her campaign rhetoric might indicate.

In the developed world, the UK government moved to the left and Europe tilted to the right. It is too early to be sure how these results might affect capital markets, though I did read a report suggesting Europe’s rightward move might align it less with the US and more with Eurasia.

Looking beyond this year’s elections, it seems clear to me that the global power model is changing. The second half of the 20th century was defined by bipolar superpowers, the US and the USSR, while in the early 21st century, the US stood as the sole superpower. The world now seems to be evolving toward a multi-polar world with potentially profound implications for capital markets and the US dollar.

Even as global alliances shift, non-US investors are still steadily buying our debt. Whatever increased yield international savers might someday demand due to high US deficits, there’s no sign of it yet. Pundits and markets in general seem to be counting on the AI windfall to resolve the issue of US spending. Possibly, but that’s a very high bar for AI to meet. Of course, the other answer to steep spending is to assume foreign investors will always consider the US dollar supreme and forever ignore deficits. I’m not sure that hope is grounded in reality.

I continue to see potential in non-US investments. The prolonged period of US dollar strength, extreme outperformance by US stocks, and attractive relative valuations for non-US stocks suggest there must be a reversal at some point. We are actively making sure clients maintain their international footprint. This is critical as we begin to see better results from non-US stocks. Certainly, international markets have not kept pace with the Nasdaq 100 or the US tech sector in general. However, looking beyond the S&P 500 Index, several non-US stock markets are performing in line with the rest of the US market, excluding the Magnificent Seven and tech in general.

Diversification Matters Because Equity Cycles Will Endure

Markets are currently in a virtuous cycle that could go on for a bit. However, sooner or later all cycles end and US fiscal excesses could catch up to us. I struggle when I hear that valuations don’t matter, that deficits don’t matter, that narrow market leadership might actually be healthy. When investors indiscriminately assert that this rule or that doesn’t matter anymore, I get nervous. I firmly believe in the fundamental rules of investing.

Pitcairn clients are doing well in the current environment. Portfolios are postured toward risk as the market has continued to rise. Nonetheless, I believe strongly that now is the time to ensure appropriate diversity in portfolios. In general, investors do not seem to be employing enough diversification at what may be the tail end of this market. For many people, it’s difficult to remain committed to international stocks and fixed income in the current environment. Fortunately, we strive to keep our families better positioned.

Investing rules and valuations still apply. No matter how powerful the earnings potential of AI may be, it will not put an end to bull and bear cycles.

In keeping with our commitment to diversification, we are expanding the alternative solutions we offer clients and are also introducing a very exciting suite of private credit products to complement existing fixed income offerings. Incorporating these into our client portfolio models will increase diversity, which we believe is particularly advantageous

in the current environment.

These additions are rooted in our firm belief that sound investing rules still apply, that valuations matter, and that no matter how powerful the earnings potential of AI may be, it will not put an end to bull and bear cycles. “Would I be comfortable with my current portfolio if equity markets fell 15% in a given year?” If your answer is no, then now is the time to build in more diversity and risk protection so that no matter what happens, five years from now you will still be moving forward to your long-term goals.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.