-

Who We Are

Who We Are

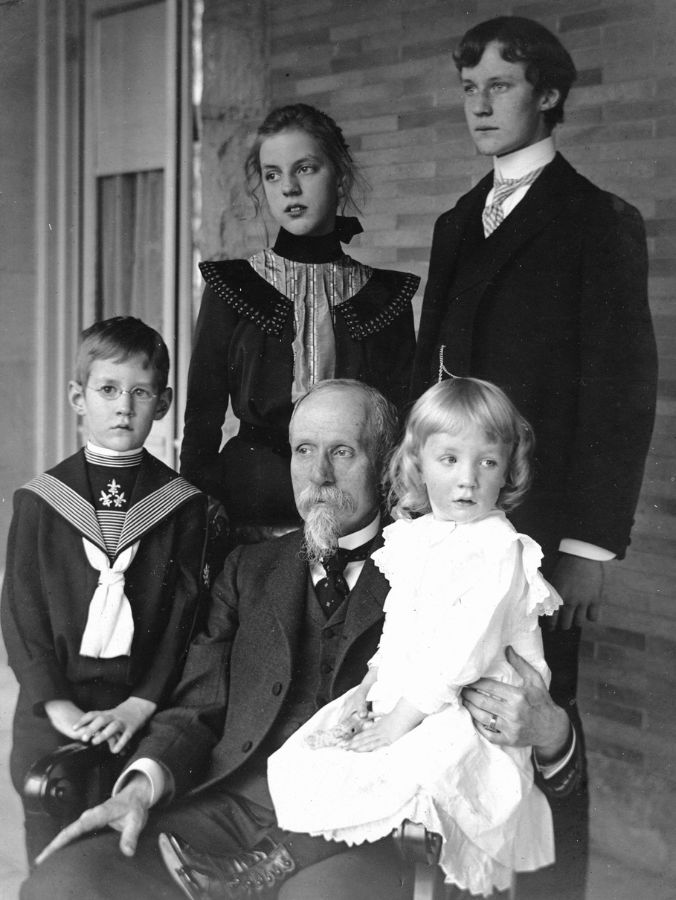

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Extreme weather conditions such as hurricanes in Florida to historic drought and rains in California are intensifying natural disaster losses both in size and frequency. Understanding how you can insure against the risks your property may face — be they wildfires, hurricanes, deep freezes or floods — is more important than ever.

It’s a sad reality that many property owners aren’t properly insured against these threats. Either they don’t realize that their homeowners insurance doesn’t cover certain perils or they underestimate their risk. Let’s review some situations and the types of coverage you may want to consider.

Flooding

Two of the biggest misconceptions about flood damage are that homeowners insurance covers it and that if your area isn’t at risk of flooding, you don’t need flood insurance.

When it comes to homeowners’ insurance, many people assume they’re covered for some level of flood damage. But even if you have a broad all-perils policy, it will have a list of exclusions. Some are causes of damage that no insurance policy will cover, like acts of war. Others are things you’ll need a separate policy to insure against.

Floods — groundwater coming into your home from the outside — fall into that category. Homeowners insurance generally covers water damage, but it does not cover flood damage; you must purchase flood insurance to insure against this risk.

Not being in a high-risk flood zone as defined by FEMA doesn’t mean your home cannot flood. Nearly 6 million U.S. homes face substantial flood risks not identified by FEMA according to First Street Foundation, a non-profit that quantifies climate change risks to American properties.

Your potential loss, if a flood does occur, is likely large enough for flood insurance to be worth it — not only for the initial incident, but for possible subsequent damage.

If your basement floods and you don’t have flood insurance, you repair the damage and take the loss but two years later, your basement has a mold problem. Your homeowners insurance most likely will not cover the mold because it was probably caused by the flooding, which isn’t a covered peril under your homeowners policy.

So how do you get flood coverage? The National Flood Insurance Program (NFIP) provides basic coverage of up to $250,000 for structures and $100,000 for personal property.

Because of the NFIP relatively low limits and the policy’s exclusions, many property owners need supplemental coverage. You can get solid financial protection against flood damage to your property and possessions by combining an NFIP policy with a private policy called excess flood.

Excess flood for high-net-worth property owners can provide full replacement cost coverage for your home and contents; reimburse you for the cost to live elsewhere while your home is repaired; and replace basement improvements.

Hurricanes

Homeowners insurance in most states will cover wind damage, however, in hurricane-prone states, you’ll have to purchase a separate windstorm policy or rider to protect your property against hurricane damage. You should also couple this with a flood policy to cover any groundwater as well.

Windstorm insurance isn’t always easy to obtain. Some properties are only eligible for a policy from a state-run high-risk pool (such as Florida’s Citizens Property Insurance Corporation). Plus, in anticipation of a hurricane and after a disaster hits, there may be a moratorium during which you can’t purchase a new policy. Give yourself plenty of time to consider your options.

In some locations, depending on the insurer and your property’s characteristics, you may need to secure flood insurance first as a condition of being eligible to purchase windstorm insurance.

It’s important to purchase flood and windstorm insurance well before you think you might need them. Flood insurance typically doesn’t provide coverage for the first 30 days after you buy your policy. And when a hurricane is approaching, you won’t be able to purchase windstorm coverage or increase existing coverage.

Wildfires

Homeowners insurance covers wildfires with the same deductibles and limits that apply to the policy’s other covered perils. The challenge here is that homeowners insurance has become increasingly expensive and difficult to secure in wildfire-prone areas.

The number of acres burned annually in wildfires was substantially higher from 2001 through 2021 than it was from 1980 through 2000 according to data supplied by the National Interagency Fire Center and published by the Insurance Information Institute (III). And eight of the 10 costliest wildfires (adjusted for inflation) in recorded U.S. history occurred in 2017 or later, according to Aon data published by III.

Insurance companies that cover high-net-worth individuals may offer better protection against wildfires than mass market insurers. For example, they may help you assess your home’s unique risks and recommend ways to reduce them. They may also send wildfire mitigation specialists to your property during a wildfire to remove combustible material and apply flame-retardant gel to your home. And if your home is damaged or destroyed, they tend to offer superior customer service that minimizes disruptions to your life, making it easier to rebuild or move.

As with windstorm insurance, some high-risk properties may only be insurable through a state high-risk pool such as California’s FAIR Plan or through surplus lines insurers. This coverage is typically more limited and far costlier than regular homeowners insurance.

For example, you may need to purchase both a FAIR Plan policy to cover the fire hazard and a second extended coverage policy to match the protection a standard homeowners policy would provide.

How Pitcairn Can Help

At Pitcairn, insurance services are part of our Wealth Momentum service model. We offer our insurance clients an annual Risk Management Review to identify any gaps in coverage. Our experts can analyze your existing policies line by line to look for places where you’re over- or underinsured, point out risks you may not have considered, and present solutions you may be unaware of.

Our insurance clients find that our insurance services and the annual risk review bring them additional value and more peace of mind. Let us know if you’d like to learn more about how we can help.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.