-

Who We Are

Who We Are

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

As the person who created your family’s wealth or as the first in line to inherit, you hold a position of great power and responsibility. You’ve also seen what it took for your family to arrive where it stands today. Now, you’re concerned about the transition of your family’s fortune to the next generation. How will they preserve not just the assets, but the values that created them?

Succession planning is tough for any successful enterprise, and it’s even harder when complex family emotions are involved. There can be fierce love and loyalty, but also issues of control and resentment, unspoken expectations, and incorrect assumptions. That’s why an intentional approach to wealth stewardship guided by a neutral third party can be so valuable.

What Could Go Wrong?

Prosperous families understand that wealth is a means, not an end. Wealth can smooth life’s rough edges, but it can also create new ones, especially with those closest to you. Ultimately, our personal relationships matter most, which means that preserving and passing on wealth requires nurturing ties among different generations of family members.

When wealth creators or inheritors lose sight of this relationship aspect, things can go awry. We recently worked with a family where the wealth creator, a robust man in his 80s, died unexpectedly after a brief illness, and his son, who was in his 60s, inherited the family business. The son never considered how other members of his family, including his own adult children, saw themselves in relation to the future of the family business. Everyone was caught off guard when he sold it.

Even though he shared the proceeds, his children hadn’t wanted a pile of money — they’d wanted a role in the business’s future. Suddenly, everything they thought would one day be theirs was gone. They hadn’t seen it coming and they hadn’t had a say. They were confused, angry, and devastated. Their trust had been damaged.

We were hired to help with family governance, but we soon realized that our first task was to repair the family’s relationships. This reconciliation would be key to helping the family move forward.

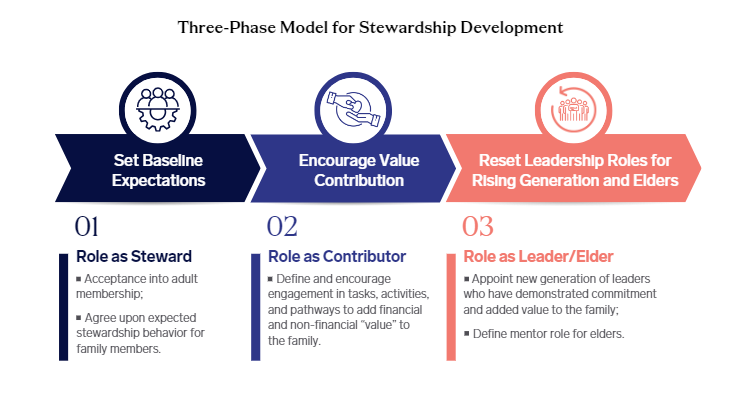

Ideally, we would have been working with this family earlier to create a long-term plan that would have prevented this rupture. We developed a three-phase stewardship process, with input from the family and informed by the family dynamics, that engages multiple generations, facilitates communication, and strengthens family bonds while preserving and enhancing values.

Phase 1: Set Baseline Expectations for a Family Steward

Being a family steward means prudently managing the family’s wealth and reputation. Stewardship is not a birthright, nor can it be forced on someone. It’s a responsibility that must be earned as well as accepted.

Older family members can help by providing consistent messaging and creating opportunities for the rising generation to learn together and get to know each other better, especially as families grow larger or become geographically dispersed.

The rising generation must also be willing to invest their time in more formal, specific education to prepare for their future wealth stewardship roles. For example, attending intensive workshops and conferences conducted by industry associations like Family Office Exchange or the Family Firm Institute. Enrolling in executive education business school courses on family office management, family foundations, philanthropy or ESG investing might also be worth pursuing.

Elders can offer guidance on the type of knowledge or skills required of the rising generation and then let those younger family members conduct their own research and seek out the educational opportunities that are a good fit.

Whatever the approach the family enterprise takes, young adults and married-in family members need clear guidance from their elders to develop the competencies required for successful wealth stewardship. Preparing for a family leadership role may include attending and observing board meetings, serving on committees, and perhaps even voting on key issues.

Future wealth stewards may also need to:

- Understand and agree to live by the family’s shared values.

- Attend and be active in key family events and activities.

- Adhere to family rules for communication, personal relationships, and social media.

- Create and follow a personal plan to develop skills that could make a positive difference.

- Understand the family’s business, legal trusts, and governance structure.

As the rising generation gains relevant experience and shows a commitment to learning and growth, the family enterprise should have a ceremony or celebration to recognize the younger family member’s achievements as they step into a new role within the family business or foundation.

Phase 2: Encourage Value Contribution and Increased Engagement

Family elders can’t simply declare that a family culture exists. To inspire the next generation to accept a family stewardship role — and to uphold it once accepted — the older generation must affirm and support the family culture through their daily actions. They must also continuously make younger stewards aware of what roles are available, what they require, and how to get involved — even if they work outside the family enterprise or are full-time caretakers for children or aging relatives.

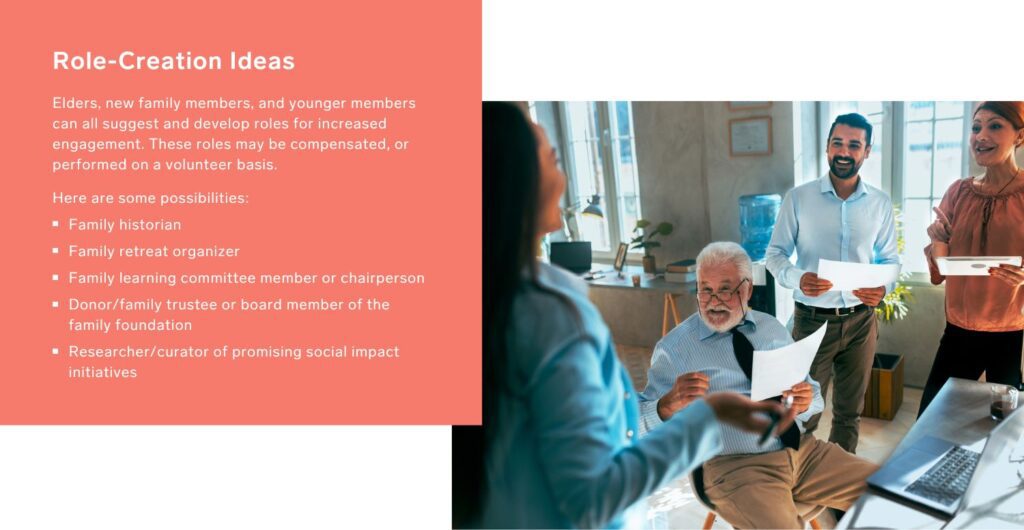

Through both observation and involvement, the rising generation learns and demonstrates its capacity for greater family responsibility. In addition to roles within the family business or foundation, there may be roles within the family council or family office. Where appropriate roles do not exist, the older generation may be able to create them.

Families can struggle in phase 2 if the senior generation does not recognize that the rising generation and young adults may have outside interests or individual strengths. Increasing family engagement requires the elder generation to be curious and open minded about younger family members’ life experiences and interests. The family enterprise will need to adapt and change over time, and to do that, it will need fresh ideas, new inspiration, and a spirit of inclusivity. Making younger people feel welcome and heard is an essential step toward preparing them to guide the family forward.

Phase 3: Transition Leadership Roles for Rising Generations and Elders

Nothing in life is guaranteed. But it’s one thing to be denied a promotion by a company you have no real connection to. It’s another to feel like your own family impeded or overlooked you in that next big step in your personal or professional growth. The younger generation can feel excluded and family relationships can fracture when this happens.

Sometimes family elders are eager to retire and hand over the reins. Others prefer to hold onto their conventional leadership roles for as long as they’re mentally and physically able. Certainly, no one should be forced out of a role that they’ve created through hard work.

In any case, it’s important to create a succession plan that helps the younger generation step in at mutually agreed upon times. This transition plan might include setting term limits for board and leadership positions, suggestion a retirement age range for certain roles, or creating a five-year roadmap of increasing responsibility for the rising leader and decreasing responsibility for the family elder.

Whatever the arrangement, everyone must feel that their wishes and efforts are valued and respected. Rising leaders need to feel confident that their engagement will be rewarded if they follow an agreed upon plan. They also need to respect the wealth creators in their family and learn as much as they can from them while they have the opportunity.

Implementing Stewardship in Your Family

Every wealthy family needs a long-term plan to sustain its assets and values. This plan should engage multiple generations to ensure a smooth transition through a process that brings the family closer together. Failing to plan puts everything at risk. Poor communication, miscommunication, and unspoken expectations can lead to hurt feelings, fractured relationships, and instability within the family enterprise.

Any family that doesn’t feel equipped to manage this process on its own might find value in working with an outside expert like Pitcairn. We have a century of experience helping families navigate these thorny issues and come out stronger because of our process and their commitment. We’re always looking for new opportunities to make an impact and would welcome the opportunity to hear your story, discuss your concerns, and develop a plan together.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.