-

Who We Are

Who We Are

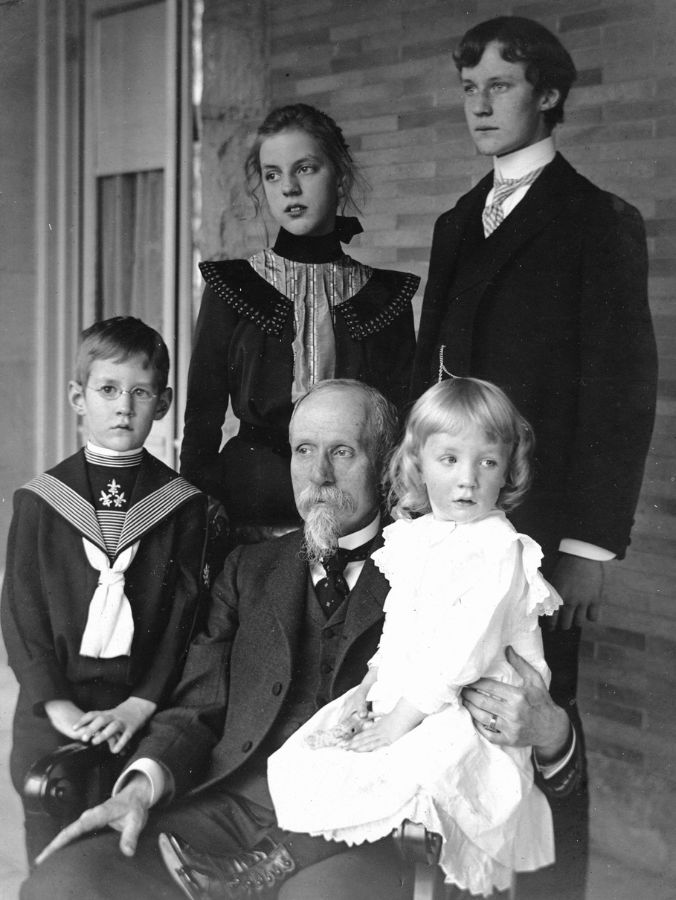

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Capital markets have been on a rocky ride in 2022. A perfect storm of rising inflation, an uncertain outlook for economic growth, and geopolitical turmoil has upended equity markets (and most other asset classes). Some investors began asking themselves — is it time to sell assets?

Over the past decade, investors may have asked this same question for a very different reason. Through most of the 2010s, US equities hit one high after another, with valuations generally staying above their 25-year average. Faced with an aging but still climbing bull market, many investors struggled against the well-established “disposition effect” — the urge to sell assets at a “high” to lock in gains.

Conversely, when markets fall, investors wonder whether they should sell stocks to guard against possible future losses.

Whether you are apt to be more cautious when stocks are high or when they are low, we strongly recommend against selling any assets or making changes to your wealth plan based on emotion or short-term market conditions. Rather, take a deep breath and lean on your trusted family advisor to make sense of market dynamics and keep you on the path leading to your long-term goals.

Here are some truths that support staying fully invested that may help you withstand the urge to sell when the future appears uncertain.

1. A falling market will eventually rise

Pessimists focus on the maxim that what goes up must come down. Markets tell us the reverse is just as likely: a bull market follows every bear. Stocks have unfailingly resumed an upward trend after every period of falling prices. Consider that those who remained fully invested through the historically long bull market of the 2010s enjoyed exceptional returns while those who nervously waited for a buying opportunity missed out.

2. Anchoring to recent experiences can be detrimental

When looking toward the future, there’s a natural tendency to assume that current trends — good or bad — will continue. Similarly, we sometimes give greater weight to recent events when making decisions. These tendencies lead to less-than-ideal choices. For instance, the COVID-19 pandemic sparked a substantial equity decline in March 2020. Emotional investors sold at the bottom of the dip, locking in losses, and then took far too long to reenter the market. By August 2020, stocks had fully recovered and subsequently delivered substantial gains. Investors who anchored themselves to events at the beginning of the pandemic suffered significant damage.

3. Anecdotes and emotional stories are not useful indicators

Multiple major market corrections have occurred in the past two decades, from the dot-com bubble in 2000 to the 2008 global financial crisis and the 2020 pandemic pause, with lesser fumbles in 2011, 2015, and 2017. Internalizing jitters based on news stories, social media, or dinner party conversations may cause investors to act on emotion. Instead, tune out the noise and look to history as a guide. Long-term equity data tells us unequivocally to stay in the market, especially through downturns.

4. Market timing does not work

No one can predict when the market will stop going up or down. No one can predict when the market will go up or when it will go down. Every new high could be the top and every new low could be the bottom. Historically, markets have found their bottom ahead of other indicators; stocks can start trending higher even though economic data continue to decline. This phenomenon makes it very difficult to time a reentry and usually means missing a substantial portion of the upswing. By the time a rising trend is evident, investors are jumping back into the market at a price higher than where they sold. The chart above illustrates a fundamental principle of successful capital growth: you must be fully invested to fully benefit from equity appreciation over time. Missing just the five best market days over 25 years can significantly reduce your return.

5. Markets have historically had more bull days than bear days

A bear market happens, on average, every three to four years, with an average length of less than 10 months. In contrast, the average bull market is much longer, lasting nearly 3 years. And, remember, even during bear markets, equities experience bull days. Roughly 56% of the largest single-day gains have occurred within a bear market. Historically, 53% of trading days are up and 47% are down. Remaining fully invested puts the odds in your favor.

6. It’s always darkest before the dawn

Consumer confidence signals future equity returns. A trough in consumer confidence often precedes a period of notable equity gains. In fact, following the eight troughs in the Consumer Sentiment Index, the S&P 500 Index returned an average of nearly 25% over the next 12 months. Investors tempted to get out of the market now should note that the Consumer Sentiment Index reached a more-than-50- year low in June of 2022.

7. A fully invested portfolio is not a passive portfolio

Pitcairn’s long-term investment discipline is not a set-it-and-forget-it exercise. Our active managers across asset classes continually adjust portfolios to take advantage of market mispricing. When markets gyrate, we take action on your behalf so you don’t have to. Additionally, through all market cycles, we actively harvest losses in your accounts, providing an offset for gains and enabling you to take advantage of both market advances and market declines.

8. Communication is key when uncertainty abounds

As the natural ebb and flow of markets becomes a bit more choppy, turn off the news and reach out to your Pitcairn relationship manager to discuss how current conditions may affect your overall wealth management plan. We can review any upcoming liquidity needs, talk about your family’s Wealth Momentum, and chart the best path in unsettled waters.

Disclaimer: Pitcairn Wealth Advisors LLC (“PWA”) is a registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Registration does not imply a certain level of skill or training. Additional information about PWA, including our registration status, fees, and services is available on the SEC’s website at www.adviserinfo.sec.gov. This material was prepared solely for informational, illustrative, and convenience purposes only and all users should be guided accordingly. All information, opinions, and estimates contained herein are given as of the date hereof and are subject to change without notice. PWA and its affiliates (jointly referred to as “Pitcairn”) do not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility thereof. As Pitcairn does not provide legal services, all users are advised to seek the advice of independent legal and tax counsel prior to relying upon or acting upon any information contained herein. The performance numbers displayed to the user may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past investment performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees, transaction costs, or other expenses associated with investable products. It is not possible to invest directly in an index. Projections are based on models that assume normally distributed outcomes which may not reflect actual experience. Consistent with its obligation to obtain “best execution,” Pitcairn, in exercising its investment discretion over advisory or fiduciary assets in client accounts, may allocate orders for the purchase, sale, or exchange of securities for the account to such brokers and dealers for execution on such markets, at such prices, and at such commission rates as, in the good faith judgment of Pitcairn, will be in the best interest of the account, taking into consideration in the selection of such broker and dealer, not only the available prices and rates of brokerage commissions, but also other relevant factors (such as, without limitation, execution capabilities, products, research or services provided by such brokers or dealers which are expected to provide lawful and appropriate assistance to Pitcairn in the performance of its investment decision making responsibilities). This material should not be regarded as a complete analysis of the subjects discussed. This material is provided for information purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest or any other security or financial instrument.