-

Who We Are

Who We Are

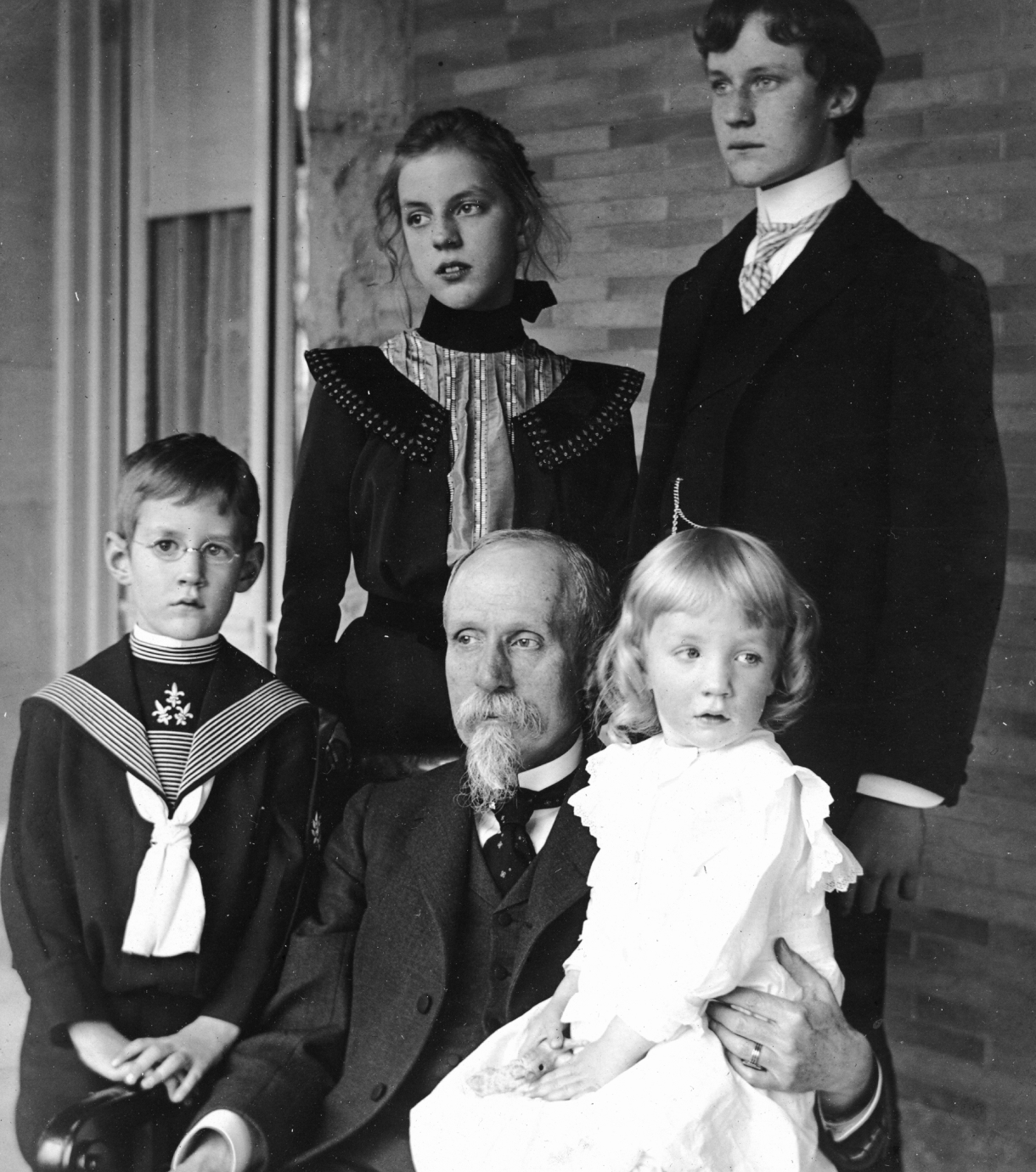

For the last century, we’ve dedicated ourselves to empowering families like yours to prosper and endure. Like many of the leading families we serve, we have been through our own wealth journey.

Discover Pitcairn -

What We Do

Wealth Momentum®

The families we serve and the relationships we have with them are at the center of everything we do. Our proprietary Wealth Momentum® model harnesses the most powerful drivers of financial and family dynamics, maximizing the impact that sustains and grows wealth for generations to come.

Explore - Insights & News

Wealth Momentum®

We believe families experience better outcomes through holistic wealth management. Wealth Momentum® is our integrated, multi-specialty family office service model. It operates at the intersection of family and wealth, balancing the totality of financial services and family dynamics. Our dedicated relationship managers drive our approach, coordinating all aspects of your comprehensive wealth plan.

Wealth Momentum® helps families by:

- Aligning wealth planning with family goals

- Delivering excellent financial results

- Clarifying family roles to improve cohesion and reduce friction

- Strengthening family bonds

- Supporting current family enterprise leaders and preparing the rising generation to be excellent wealth stewards

The Clients We Serve

Since our founding in 1923, we have consistently recognized one overarching truth: No two families are the same. This is why chemistry and achieving a true partnership with those we serve is so important to us. Because of our high-touch approach, we generally invite only three to five new families a year to join Pitcairn, ensuring that each family has an outstanding, highly personalized experience. Our clients generally have:

- Complex wealth structures such as assets held in trusts

- At least $50 million in investable assets

- A desire to strengthen or enhance family decision making and family governance

- A need to prepare the rising generation to become wealth owners or inheritors